Amazon.com: Value Added Tax: A Comparative Approach (Cambridge Tax Law Series): 9781107617629: Schenk, Alan, Thuronyi, Victor, Cui, Wei: Books

Value Added Tax: A Comparative Approach, With Materials & Cases: 9781571051707: Schenk, Alan, Oldman, Oliver: Books - Amazon.com

Amazon.com: Value Added Tax: A Comparative Approach (Cambridge Tax Law Series): 9781107617629: Schenk, Alan, Thuronyi, Victor, Cui, Wei: Books

Data Analysis, Hardcover by Govaert, Gerard (EDT), Like New Used, Free shippi... 9781848210981 | eBay

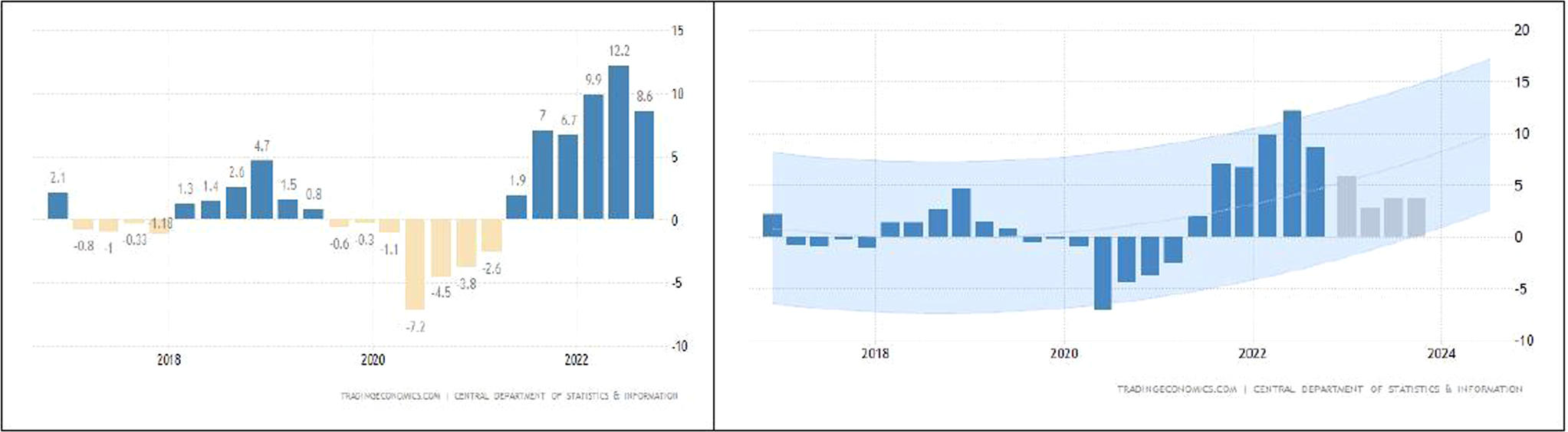

Value-added-tax rate increases: A comparative study using difference-in-difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

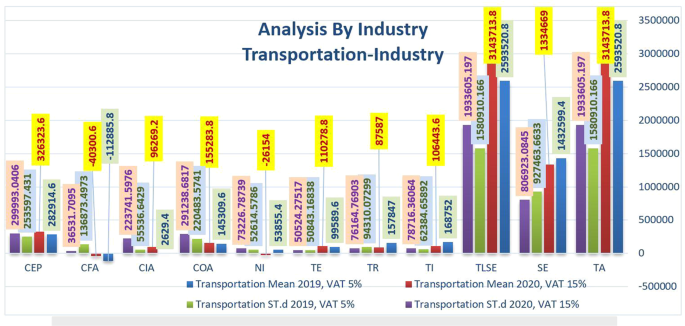

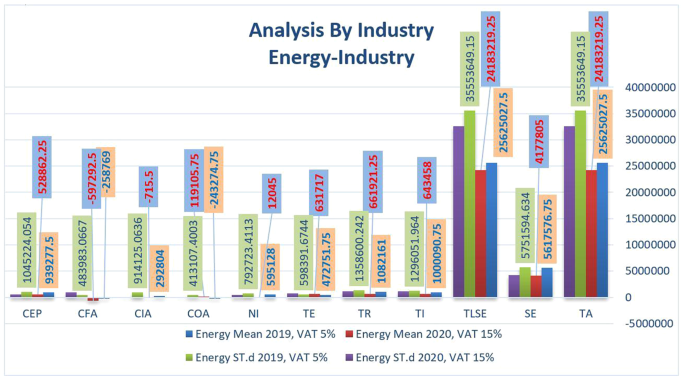

Value-added-tax rate increases: A comparative study using difference-in-difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

Value-added-tax rate increases: A comparative study using difference-in-difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

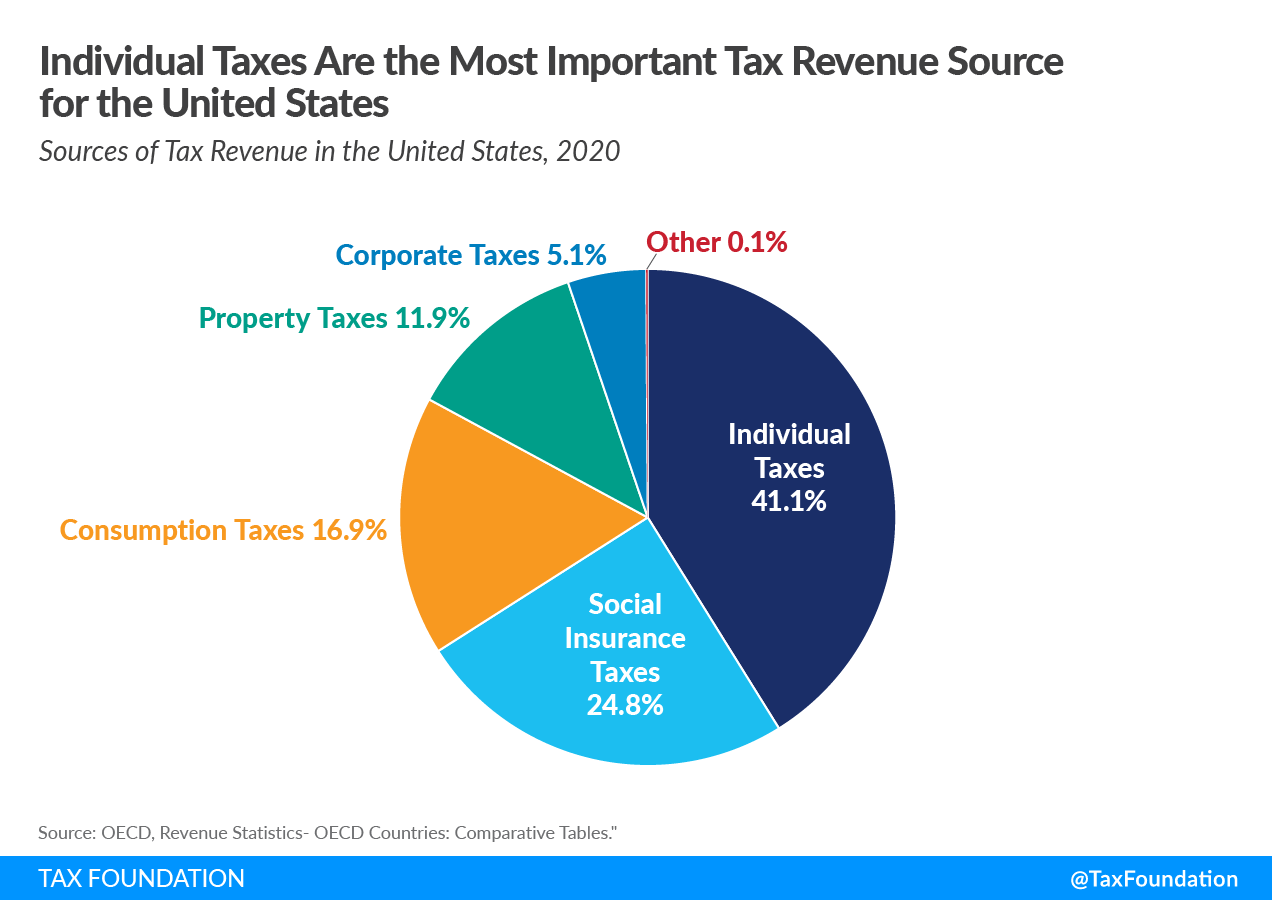

Value-added-tax rate increases: A comparative study using difference-in-difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

Value-added-tax rate increases: A comparative study using difference-in-difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

Value Added Tax: A Comparative Approach (Cambridge Tax Law Series) - Kindle edition by Schenk, Alan, Thuronyi, Victor, Cui, Wei. Professional & Technical Kindle eBooks @ Amazon.com.

Amazon.com: Value Added Tax: A Comparative Approach (Cambridge Tax Law Series): 9780521851121: Schenk, Alan, Oldman, Oliver: Books

Amazon.com: Value Added Tax: A Comparative Approach (Cambridge Tax Law Series): 9780521851121: Schenk, Alan, Oldman, Oliver: Books

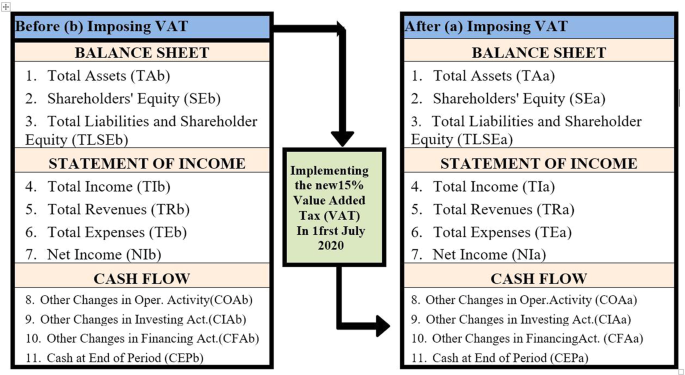

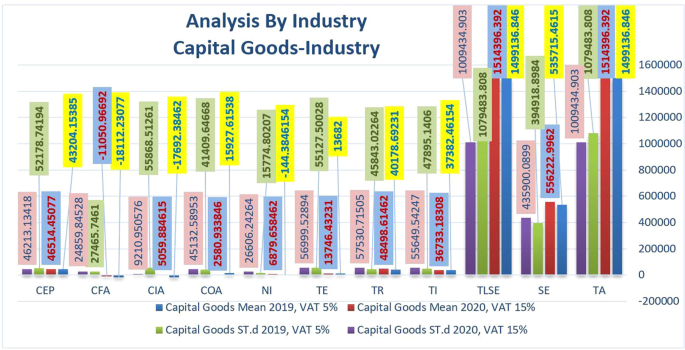

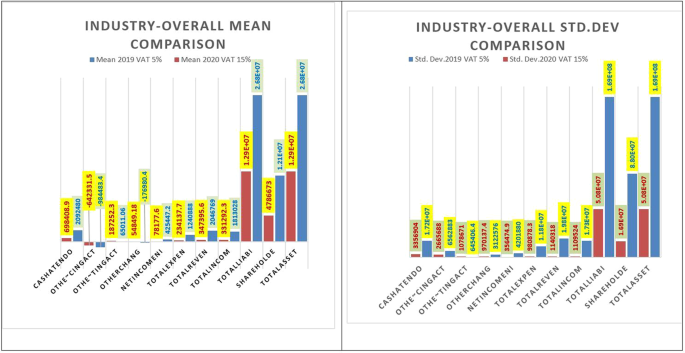

![PDF] THE ECONOMIC AND SOCIAL IMPACT OF THE ADOPTION OF VALUE-ADDED TAX IN SAUDI ARABIA | Semantic Scholar PDF] THE ECONOMIC AND SOCIAL IMPACT OF THE ADOPTION OF VALUE-ADDED TAX IN SAUDI ARABIA | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/6ff059c99a8f4eba21eec716b24a43c2b8923812/3-Figure1-1.png)

PDF] THE ECONOMIC AND SOCIAL IMPACT OF THE ADOPTION OF VALUE-ADDED TAX IN SAUDI ARABIA | Semantic Scholar

Value-added-tax rate increases: A comparative study using difference-in-difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

Amazon.com: Value Added Tax: A Comparative Approach (Cambridge Tax Law Series): 9780521616560: Schenk, Alan, Oldman, Oliver: Books

VALUE ADDED TAX: A COMPARATIVE APPROACH, SECOND EDITION. By ALAN SCHENK, VICTOR THURONYI, and WEI CUI